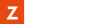

US Federal Reserve Chair Jerome Powell said Wednesday that macroeconomic data have not given Federal Open Market Committee (FOMC) members confidence this year to begin rate cuts.

"The most recent inflation readings have been more favorable than earlier in the year, however, there has been modest progress toward our inflation objective," Powell said at a news conference after the Fed's two-day meeting concluded.

"We need to see more good data to bolster our confidence that inflation is moving sustainably toward 2%," he added.

Powell said inflation data from earlier this year were higher than expected, although more recent monthly readings have "eased somewhat."

"Inflation has eased substantially from a peak of 7% to 2.7%, but it is still too high," he said. "We are maintaining our restrictive stance of monetary policy in order to keep demand in line with supply, and reduce inflationary pressures."

The Fed chair said the labor market has come into a better balance with continued strong job gains and a low unemployment rate.

"As labor market tightness has eased and inflation has declined over the past year, the risks of reaching unemployment and inflation goals have moved towards better balance," he said. "Our economy has made considerable progress towards both goals of maintaining maximum employment and stable prices."

He said economic activity continued to expand at a solid pace, although GDP growth moderated from 3.4% in the fourth quarter last year to 1.3% in the first quarter this year.

Powell noted that the economic outlook remains uncertain, while FOMC members remain highly attentive to inflation risks.

"We know reducing policy rate too soon, or too much, could result in a reversal of the progress we have seen on inflation. At the same time, reducing policy rate too late or too little could unduly weaken economic activity and employment," he said.

"If the economy remains solid and inflation persists, we are prepared to maintain the current target range for the federal funds rate as long as appropriate," he added.

The comments came after the Fed kept its federal funds rate unchanged between the 5.25% - 5.5% target range, as widely expected, which is the highest in 23 years.

The central bank, however, signaled it expects one interest rate cut this year, according to its projection materials that were released earlier.

Powell did not hint when the cut would happen, but said FOMC members do not see themselves as "having the confidence that would warrant beginning to loosen policy at this time."

"We see today's report as progress and as building confidence," he said, referring to the latest consumer price index figures that were released earlier in the day.

Consumer inflation in the US annually rose 3.3% in May, slightly slowing from April's 3.4% increase; and showed no monthly gain, according to Labor Department figures.

Another critical figure that the FOMC closely monitors is the non-farm payroll data that indicates the overall stance of the job market.

The American economy added 272,000 jobs in May, much more than estimates of 182,000, according to Labor Department figures released Friday. Data showed that the labor market remains hot, and increased the possibility that the Fed's first rate cut could be further delayed in 2024.

Powell said there is an argument that the jobs figures may be "a bit overstated" and added, "but still, they're strong."

"We see gradual cooling (in the labor market), gradual moving toward better balance," he added.

The Fed still does not eliminate the possibility of rate hikes, according to Powell who said no FOMC member has interest rate increases in their base case in the projections.

He said it is too soon to say if the Fed's monetary policy is "sufficiently restrictive" but added that its effects are evident, such as the pace of price increases coming down significantly.

"Consumer spending is still growing, but not at the same pace a year ago, and other parts of the economy are picking up, showing "solid growth," he said.

"It is going to be the totality of data" for the FOMC to gain confidence to begin rate cuts, according to Powell, such as labor market and economic growth data.

"In terms of inflation, you wanna see real progress that builds your confidence that we are on a path down to 2%," he said.

The FOMC looks at inflation "at the aggregate level" and does not single out certain price increases or decreases in different sectors, such as the housing market, said Powell.